Business Services

“We are a new business, just getting started, Above All Accounting was essential in getting us started with the correct business structure, strategy and plan. Bringing us up to speed to the numerous and newest tax codes, concerning our particular business… I highly recommend Above All to anyone, but especially small businesses.” – 3 DD

Or, call our team now 305-600-0717

Services We Offer

Financial Statements

Skillfully crafting tailored financial statements, including the essential Profit and Loss (P&L) or Income Statement and the Balance Sheet, is a core expertise at Above All Accounting LLC. Our commitment extends to providing insights on Changes in the Cash Flow and Retained Earnings. Count on us for transparent and professional financial documentation, ensuring a robust foundation for your business.

Accounting and Bookkeeping Services

Our services encompass the establishment and upkeep of bookkeeping and other business software systems. We diligently review bookkeeper entries, conduct bank reconciliations, and manage adjusting and closing general journal entries. Our goal at Above All Accounting LLC is to provide comprehensive accounting and bookkeeping services that contribute to the seamless financial operation of your enterprise.

Payroll and Payroll Taxes

We offer various automated payroll system options, handling everything from setup to filing quarterly reports. Our services extend to providing Annual Federal and State Tax Forms, including unemployment tax. Additionally, we offer expert guidance on workman’s compensation insurance and the creation of pension plans.

Our administrative payroll-related services go beyond the numbers. We undertake tasks such as crafting employee manuals, fostering effective communication with employees, and meticulously preparing reports. At Above All Accounting LLC, we ensure that every aspect of your payroll needs is skillfully managed.

Sales Taxes

Managing sales tax can be complicated, especially for businesses selling in various states. At Above All Accounting LLC, we streamline the process of filing sales tax forms for businesses operating across multiple states. Each state possesses its unique tax rates and taxable items, varying even within local areas. Additionally, many states impose additional sales tax percentages for various regions within the state. Our expertise ensures that, for any state with sales tax obligations, we efficiently handle the filing of sales tax forms, alleviating the complexities associated with multi-state sales.

Franchise Taxes

It’s essential to note that not all states have franchise taxes. We specialize in filing franchise taxes for states that do impose such obligations. Currently, the states requiring franchise tax filings include Alabama, Arkansas, Delaware, Georgia, Illinois, Louisiana, Mississippi, Missouri, New York, North Carolina, Oklahoma, Pennsylvania, Tennessee, Texas, and West Virginia. Our dedicated services, provided by Above All Accounting LLC, ensure accurate and timely filing, addressing the unique franchise tax requirements in each applicable state.

Tax Returns

In filing various types of tax returns, Above All Accounting LLC caters to businesses, fiduciaries, and partnerships. Our expertise extends to handling the intricacies of income tax filing, ensuring compliance with the requirements of states that mandate such filings. Trust us to manage the diverse forms and requirements associated with tax returns, providing comprehensive and reliable service.

Corporation

Fiduciary and Partnerships

Non-Profits

Incorporation and Dissolution Services

With meticulous precision, we manage the entire spectrum of services for incorporation and dissolution. From SunBiz license updating to filing all necessary paperwork with the IRS and State, Above All Accounting LLC ensures a smooth process for forming, renewing, or dissolving your corporation. Let us take care of the details, providing thorough support for your business needs.

Limited Liability Corporation (LLC)

“C” Corporation

“S” Corporation

Partnership

Non-Profit

Business Organization Services

Whether you’re launching a startup, reorganizing, or seeking consultation on business plans, Above All Accounting LLC is here to help. Our services focus on providing the organizational structure your business needs for a solid foundation and sustainable growth.

Consulting Services

Above All Accounting LLC extends its expertise beyond core accounting and bookkeeping practices, providing a wide array of professional consulting services.

Budget Monitoring

Cash Flow Management Analysis

Internal Controls Analysis

General Business Consultation

Debt Counseling and Consolidation

Filing of W-2s and 1099s

We specialize in the seamless setup and administration of W-2s and 1099s filings.

Non-Profit Organization Filings

Above All Accounting LLC excels in assisting with the setup and maintenance of your non-profit organization’s tax-exempt status, meticulously handling all IRS reporting on your behalf.

Parsonage Setup for Non-Profits

Ensuring compliance and efficiency in financial matters is our focus at Above All Accounting LLC, especially when it comes to the seamless setup and administration of parsonage and other allowances for your non-profit organization.

FL Notary Services

For our clients’ convenience we offer full notary services. Free in-office notary services for current clients.

Frequently Asked Questions

To choose the right bookkeeping software, consider factors like your industry, specific needs, and budget. Industry-specific packages exist, though they may come at a higher cost. Alternatively, general software like Quickbooks and Xero offer versatility. Additionally, various payroll software options are available. Jack is here to guide you in selecting the best fit for your unique requirements.

Typically, individuals and most entities are not subject to Florida State Income Tax. However, it’s important to note that C corporations are an exception to this general rule.

Choosing between an LLC and an S Corp depends on various factors, including your business structure, tax preferences, and operational needs. There are advantages and disadvantages to both entities, and Jack can provide personalized guidance to help you make the right decision. For more in-depth information, you can click here to download the AAA Business Entity Pro’s and Con’s Guide.

As part of our tax preparation assistance, I typically schedule meetings with clients towards the end of the year. During these sessions, we thoroughly review your records and bookkeeping entries. This proactive approach allows us to identify potential areas for improvement before year-end, helping you optimize your tax situation and potentially save on taxes.

The frequency of our meetings is tailored to the unique needs of your business, considering factors such as size and complexity. Typically, small businesses opt for annual meetings, while others, particularly those with great complexity, may prefer quarterly or monthly sessions. However, Jack is always available to provide guidance and support, even outside of your regular meeting schedule. Feel free to reach out to him for advice whenever you need assistance.

Still have a question? Ask Jack!

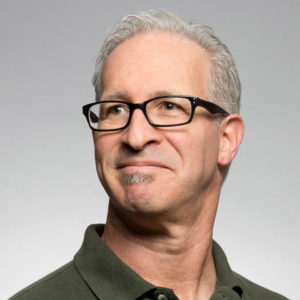

Meet Our Principle, Jack Lockspeiser , MBA

Jack Lockspeiser has a background of over 25 years in business, accounting, and finance. He earned his MBA at Ohio University. He has a wide range of experience in accounting and bookkeeping and has worked with many different bookkeeping and payroll software packages.

Hurry! Limited spots available.

Affiliations & Partners:

305-600-0717

305-600-0717