Accounting and Tax

“Jack does an excellent job with both my personal and business taxes. He is up to date on tax law and knows how and when to apply deductions. He has saved me thousands in deductions that were missed in previous years by my former accountant. Jack truly is Above All.” – Robert B

Or, call our team now 305-600-0717

Accounting & Tax

Explore our Accounting and Tax services where we simplify finances for you. We handle everything from managing taxes to organizing your financial details. Whether you run a small business or a larger company, we’re here to make sure your finances are in good shape. Think of us as your go-to team for making money matters clear and straightforward, working towards your financial success.

Frequently Asked Questions

To choose the right bookkeeping software, consider factors like your industry, specific needs, and budget. Industry-specific packages exist, though they may come at a higher cost. Alternatively, general software like Quickbooks and Xero offer versatility. Additionally, various payroll software options are available. Jack is here to guide you in selecting the best fit for your unique requirements.

Typically, individuals and most entities are not subject to Florida State Income Tax. However, it’s important to note that C corporations are an exception to this general rule.

Choosing between an LLC and an S Corp depends on various factors, including your business structure, tax preferences, and operational needs. There are advantages and disadvantages to both entities, and Jack can provide personalized guidance to help you make the right decision. For more in-depth information, you can click here to download the AAA Business Entity Pro’s and Con’s Guide.

As part of our tax preparation assistance, I typically schedule meetings with clients towards the end of the year. During these sessions, we thoroughly review your records and bookkeeping entries. This proactive approach allows us to identify potential areas for improvement before year-end, helping you optimize your tax situation and potentially save on taxes.

The frequency of our meetings is tailored to the unique needs of your business, considering factors such as size and complexity. Typically, small businesses opt for annual meetings, while others, particularly those with great complexity, may prefer quarterly or monthly sessions. However, Jack is always available to provide guidance and support, even outside of your regular meeting schedule. Feel free to reach out to him for advice whenever you need assistance.

Still have a question? Ask Jack!

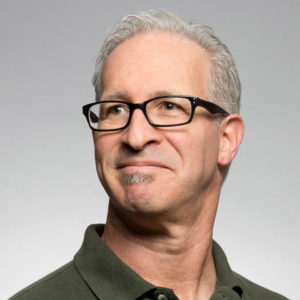

Meet Our Principle, Jack Lockspeiser , MBA

Jack Lockspeiser has a background of over 25 years in business, accounting, and finance. He earned his MBA at Ohio University. He has a wide range of experience in accounting and bookkeeping and has worked with many different bookkeeping and payroll software packages.

Hurry! Limited spots available.

Affiliations & Partners:

305-600-0717

305-600-0717