Switch Accountants

“Jack does an excellent job with both my personal and business taxes. He is up to date on tax law and knows how and when to apply deductions…Jack truly is Above All.” – Robert B

Or, call our team now 305-600-0717

SWITCHING ACCOUNTANTS

In the realm of life’s certainties, such as death and taxes, business owners often view their accountant as an inevitable footnote. The good news? You hold the power to choose. At Above All Accounting LLC, we redefine the role, offering you more than mere service; we provide a partnership for your financial success.

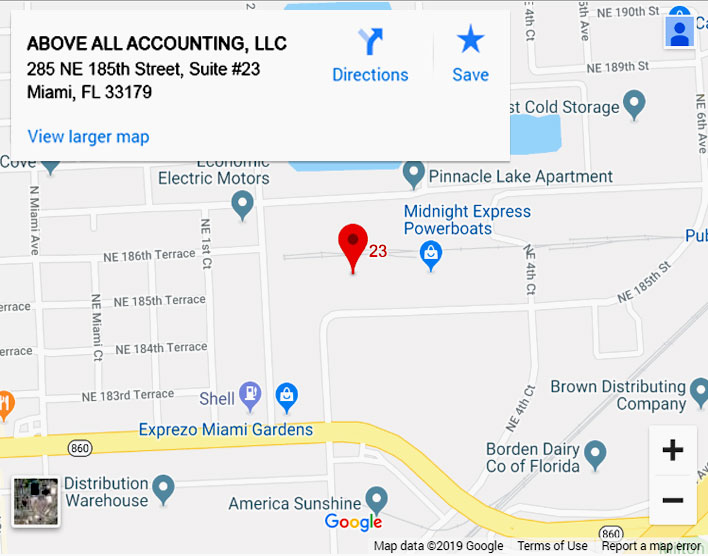

Clients transition to our service for various reasons, including business relocation, changes in accountant circumstances, outgrowing current services, or seeking enhanced accounting support. Connect with Jack today to seamlessly switch and embark on a more engaging and effective accounting journey.

The Value of Referrals

Enhancing Connections, Growing Together

At Above All Accounting LLC, we deeply value the trust and satisfaction of our clients. Many of our customers reach us through referrals , and we want to express our gratitude for your contribution to our ongoing success. When you recommend our services to your family, friends, or colleagues, it not only helps us grow but also brings in a higher quality clientele. A personal recommendation can help jump-start the business relationship, resulting in a more efficient and effective tax engagement.

Please consider sharing this brochure with individuals who might find our services beneficial.

Thank you for being an integral part of our client community.

Frequently Asked Questions

To choose the right bookkeeping software, consider factors like your industry, specific needs, and budget. Industry-specific packages exist, though they may come at a higher cost. Alternatively, general software like Quickbooks and Xero offer versatility. Additionally, various payroll software options are available. Jack is here to guide you in selecting the best fit for your unique requirements.

Typically, individuals and most entities are not subject to Florida State Income Tax. However, it’s important to note that C corporations are an exception to this general rule.

Choosing between an LLC and an S Corp depends on various factors, including your business structure, tax preferences, and operational needs. There are advantages and disadvantages to both entities, and Jack can provide personalized guidance to help you make the right decision. For more in-depth information, you can click here to download the AAA Business Entity Pro’s and Con’s Guide.

As part of our tax preparation assistance, I typically schedule meetings with clients towards the end of the year. During these sessions, we thoroughly review your records and bookkeeping entries. This proactive approach allows us to identify potential areas for improvement before year-end, helping you optimize your tax situation and potentially save on taxes.

The frequency of our meetings is tailored to the unique needs of your business, considering factors such as size and complexity. Typically, small businesses opt for annual meetings, while others, particularly those with great complexity, may prefer quarterly or monthly sessions. However, Jack is always available to provide guidance and support, even outside of your regular meeting schedule. Feel free to reach out to him for advice whenever you need assistance.

Still have a question? Ask Jack!

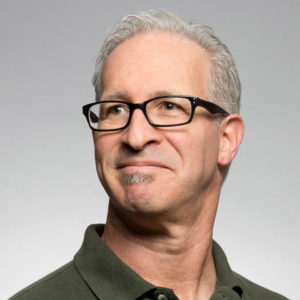

Meet Our Principle, Jack Lockspeiser , MBA

Jack Lockspeiser has a background of over 25 years in business, accounting, and finance. He earned his MBA at Ohio University. He has a wide range of experience in accounting and bookkeeping and has worked with many different bookkeeping and payroll software packages.

Hurry! Limited spots available.

Affiliations & Partners:

305-600-0717

305-600-0717